Let’s dive into the IRS Form 1040 for 2024. Taxes might seem intimidating, but with the right guidance, they don’t have to be. Today, I’m going to walk you through the form so you can tackle your taxes with confidence.First things first, form 1040 is your US individual income tax return. It’s the main form used for filing your federal income taxes. Whether you’re filing using software or filling it out by hand, understanding this form is key to managing your taxes effectively.

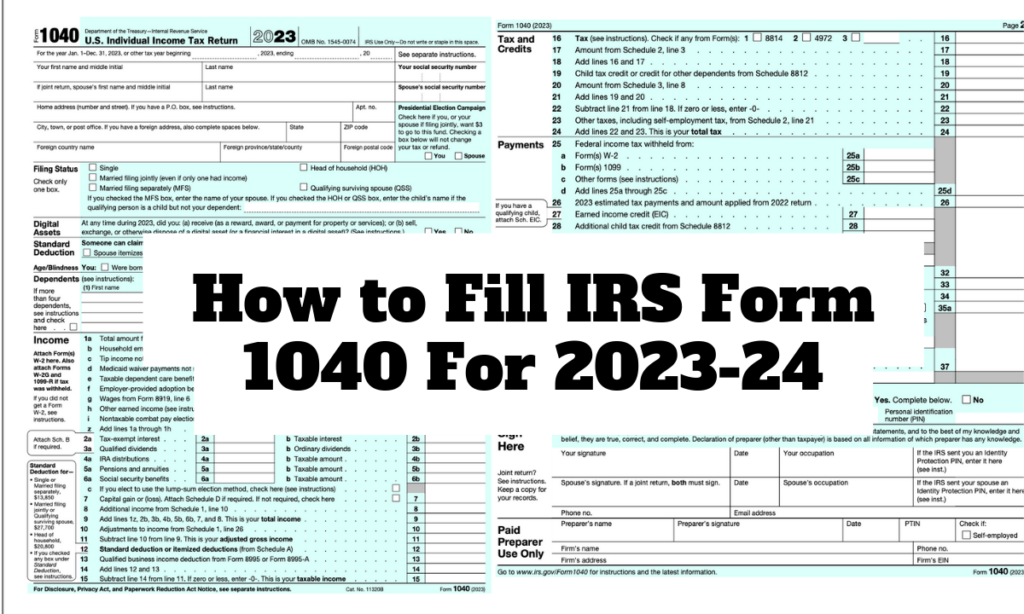

IRS Form 1040 in 2023-24

Let’s start with a bird’s eye view of the form. It kicks off with your personal information: name, address, social security number, filing status, and dependents. This might seem basic, but it’s crucial for ensuring everything else falls into place correctly.

Now, on to calculating your taxable income. This is where you add up all your income for the year: wages, salaries, bonuses, and any other income. Remember, the more accurate you are here, the smoother the rest of the process will be.

Flipping to page 2, we calculate what you owe, known as your tax liability. Here’s where you can subtract any tax credits you qualify for, as well as the taxes you’ve already paid through your job. It’s like a balancing act between what you’ve earned and what you owe. The 1040 form helps you determine if your withholdings and credits have fully covered your tax bill.

IRS Form 1040 in 2023-24 Page 1

Let’s get practical and walk through a real-life example. Imagine James, a single guy filling out his form for 2023-24. He’s entered all his personal info and is ready to dive into the details. He has filled in his name, social security number, and address information. He has also checked the single box for his filing status.

For the presidential election campaign, you have the option to check a box to contribute, though the form states that this does not affect your tax or refund. For those involved in digital assets or virtual currency, this year’s form has specific sections you need to be aware of. James hasn’t dealt with this, so he’s checked “no” for that part.

Next up, we have dependents and deductions. Key elements that can significantly influence your taxable income. Grasping who qualifies as a dependent and the deductions available to you is essential. A dependent in tax terms is someone who can qualify for a dependency exemption on your federal tax return. Including a dependent can reduce your taxable income, effectively lowering your tax liability. Plus, it can open the door to various deductions and credits. Who can be a dependent? Well, they typically fall into two categories: a qualifying child or a qualifying relative. Each comes with its own set of IRS criteria, encompassing aspects like age, residency, relationship to you, and financial support provided. Understanding these requirements is crucial as it directly affects your tax calculation. James’s situation is straightforward; he has no dependents and is not claimed as one. Be sure to check the appropriate box and fill in the lines that reflect your own situation.

Next, income reporting is where it gets interesting. James got a W2 from his employer showing he earned $6,150 this year. But what if you have multiple jobs or freelance income? You’ll need to gather all that information and report it accurately, including any W2 and 1099 forms and also estimated taxes paid. In addition, he also had some household employee wages, so he entered it as well. James had no other earned income, so he entered zero. He then added all the amounts above.

Next are questions about tax-exempt or taxable interest. Interest income is split into two types: tax-exempt and taxable. For example, municipal bonds usually yield tax-exempt interest, while interest from savings accounts or CDs is taxable. James reported $110 in taxable interest. This was more than he had last year due to higher interest rates on his accounts. The next section includes several types of income, including capital gains. Capital gains can be a bit tricky. This is the profit you make from selling assets like stocks or real estate. A capital gain or loss refers to the difference between the cost of an asset and the amount received from its sale. When an asset is sold for more than its cost, the difference is referred to as a capital gain. Conversely, when an asset is sold for less than its cost, the difference is referred to as a capital loss. James didn’t have any to report, but if you do, you’ll need to list them separately.

He also did not have other sources of income, so he added the lines to calculate his total income. He had no adjustments, so that same amount was also his adjusted gross income. If you have adjustments, you would subtract them from your total income to get adjusted gross income.

Next is the box for standard deduction versus itemized deductions, a significant choice. The standard deduction reduces your taxable income and changes yearly. The key difference between the standard deduction and itemized deductions is that the standard deduction is a fixed dollar amount, while itemized deductions are based on actual expenses incurred. To claim itemized deductions, one needs to fill out Schedule A of the form 1040. You can choose either to claim the standard deduction or itemized deductions, whichever results in the lower taxable income. However, in some cases, certain taxpayers are restricted from claiming itemized deductions or are subject to limitations in the amount of deductions they can claim.

James opted for the standard deduction, but itemized deductions can be more beneficial if you have significant expenses like mortgage interest or medical costs. He obtained that amount by looking at the left side of the page and entering the amount listed for single. James had no qualified business income deductions, so that line was left blank. After adding lines 12 and 13, he then subtracted line 14 from line 11 to get his taxable income, which is $3,210. He is then going to use taxable income to find his tax amount.

James then calculated his taxable income and used the tax table in the 1040 instructions to determine his tax amount. This year’s tax brackets have been adjusted, so make sure you’re looking at the right numbers. Using his taxable income amount, he then looked up his tax in the tax table. He made $3,210, which is at least $3,200 but less than $3,250. As a single filer, his tax amount according to the table is therefore $323. He will next enter this amount on page two of the 1040.

IRS Form 1040 in 2023-24 Page 2

Page two covers credits and other taxes. Tax credits can significantly reduce what you owe, so explore all your options here. An example of credits that can be claimed on the 1040 form includes the child tax credit. To claim a credit on the 1040 form, an individual must meet certain qualifications and provide the necessary documentation. The credits are then entered in the appropriate line on the 1040 form, and the amount of the credit is subtracted from the total tax owed.

Once again, on line 16, James entered the tax amount from the tax table. And since he had nothing on Schedule 2 or Schedule 3 and does not have any tax credits, he entered it again on line 18. James didn’t qualify for any credits, but you might, so it’s worth a thorough check to see if you do. Since he did not have any credits or other taxes, he again entered this amount as his total tax.

The next section is on federal income tax withheld. Federal income tax withheld is what’s already been taken out of your paychecks. James W2 form shows this amount. If you’ve switched jobs during the year, make sure to add up the withholding from all your W2 forms. Estimated tax payments come into play if you’ve got income that’s not subject to withholding, like freelance or investment income. Add these up to ensure you’re reporting all your payments. To find the taxes paid on a W2 form, look for the section labeled “Federal Income Tax” or something similar, which reports the amount of federal income tax that was withheld from your paycheck.

Leave a Reply